Inflation rates, how to declare a side income, HMRC tax webinar dates, plus the UK-South Korea free trade agreement

Welcome to our round up of the latest business news for our clients. Please contact us if you want to talk about how these updates affect your business.

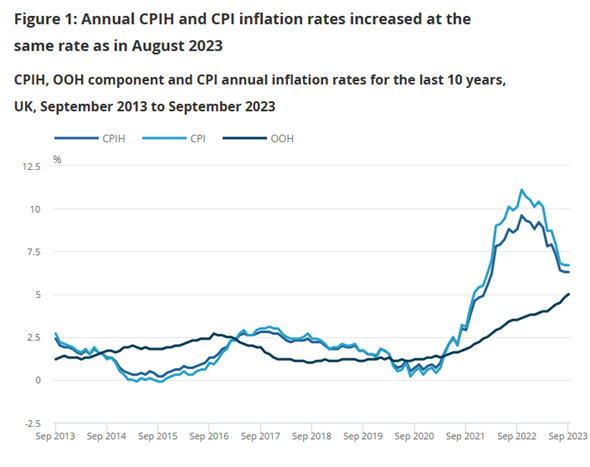

Inflation holds steady at 6.7%

UK inflation unexpectedly held stable in September at 6.7% as rising fuel costs offset the first monthly fall in food prices for two years to maintain pressure on households during the cost of living crisis.

The largest downward contributions to the monthly change came from food and non-alcoholic beverages, where prices fell on the month for the first time since September 2021, and furniture and household goods, where prices rose by less than they did a year ago.

The Consumer Prices Index including owner-occupiers’ housing costs (CPIH) rose by 6.3% in the 12 months to September 2023, the same rate as in August.

The Office for National Statistics (ONS) said the annual inflation rate as measured by the consumer prices index (CPI) remained unchanged from August’s reading, already raising questions by experts over the Bank of England’s next decision on interest rates due in November. City economists had forecast a modest fall to 6.6%.

Occupiers’ Housing Costs (OOH) increased by 5% in the twelve months to September 2023.

Source: Office for National Statistics.

So what actions can a business take now to remain resilient to any changes in the economy?

Here are a few suggestions to help you think about your business:

- Review your Budgets and set realistic and achievable targets for 2024.

- Review your debtors list and chase up overdue invoices (if appropriate).

- Assign responsibility to one individual for invoicing and collections.

- Put extra effort into making sure your relationships with your better customers are solid.

- Review and flow chart the main processes in your business (e.g. Sales processing, order fulfilment, shipping etc) and challenge the need for each step.

- Encourage team members to suggest ways to streamline and simplify processes (e.g. sit down and brainstorm about efficiencies and cost reduction).

- Review your staffing needs over the next few months.

- Review your list of products and services and eliminate those that are unprofitable or not core products/services.

Talk to us about your business, we have many clients who have changed the way they do things and some really innovative stories to share with you!

Do you have a side income?

If you do then you are probably aware of the requirement to disclose this on your Self-Assessment tax return. It is important to record any side income accurately and HMRC is going to be able to see exactly how much income you receive when using a digital platform from 1 January 2024.

HMRC have new powers which means that anyone in the UK who makes money selling goods or services online will have their incomes recorded on the digital platform that they use and HMRC will have direct access to this.

Digital platforms include apps and websites which facilitate the provision of goods and services such as the provision of taxi and private hire services, food delivery services, freelance work, and the letting of short-term accommodation.

HMRC will have access to the digital records of businesses such as Airbnb, Fiverr, Upwork, Uber, Deliveroo, Etsy and other online businesses. The change is part of a wider plan for HMRC to keep a more accurate eye on people adding to their existing income through side profits or freelancing and they will be checking tax returns to ensure the figures tally with the records from the platforms themselves.

The power to enable these regulations to be made was introduced under section 349 of the Finance (No.2) Act 2023.

From 1 January 2025, certain UK digital platforms will be required to report information to HMRC about the income of sellers of goods and services on their platform. HMRC will then exchange the information with the other participating tax authorities for the jurisdictions where the sellers are tax resident.

Under the Organisation for Economic Co-operation and Development (OECD) rules, digital platforms in participating jurisdictions will be required to provide a copy of the information to the taxpayer to help them comply with their tax obligations.

The legislation, ‘The Platform Operators (Due Diligence and Reporting Requirements) Regulations 2023’, as issued in July 2023, can be seen here: The Platform Operators (Due Diligence and Reporting Requirements) Regulations 2023 (legislation.gov.uk) and the reporting rules for digital platforms can be seen here: Reporting rules for digital platforms – GOV.UK (www.gov.uk)

If you are not currently filing a tax return then you can check how to register for Self-Assessment here: Check how to register for Self Assessment – GOV.UK (www.gov.uk)

Please talk to us if you have any questions about a side income and how to declare this on your tax return, we have considerable experience in helping our clients comply with the complex HMRC disclosure requirements.

Latest HMRC tax webinars

Listed below are a number of live HMRC webinars that will help employers with payroll. The webinars are free and last around an hour.

Expenses and benefits for your employees – social functions and parties

Wed 1 Nov at 11:45am

Expenses and benefits for your employees – trivial benefits

Tue 31 Oct at 1:45pm

Statutory Maternity and Paternity Pay

Fri 27 Oct at 9:45am

Tue 14 Nov at 11:45am

Expenses and benefits for your employees – company cars, vans, and fuel

Thu 2 Nov at 1:45pm

Expenses and benefits for your employees – phones, internet, and homeworking

Tue 7 Nov at 1:45pm

Wed 8 Nov at 1:45pm

Statutory Sick Pay

Thu 9 Nov at 11:45am

Getting payroll information right

Mon 27 Nov at 9:45am

Please talk to us if you have any payroll queries; we have extensive experience in helping our clients comply with HMRC regulations.

Exporting – Rules of origin to South Korea extended

The UK has secured a two-year extension to rules which help British companies to access lower or zero tariffs when selling goods to South Korea.

The extension has been secured under the UK-South Korea free trade agreement and comes as welcome news for businesses who can continue to avoid the high tariffs imposed by South Korea on products entering the country.

It also comes ahead of the launch of negotiations on a new, modernised trade deal between the UK and South Korea which will cover new sectors like digital, expected before the end of the year.

South Korea is the 13th largest economy in the world and set to grow rapidly and its import market is expected to grow 45% by 2035. The UK’s trade with Korea has more than doubled since the original FTA was negotiated.

Goods make up the majority of UK exports to South Korea, with £7.3 billion worth exported last year. A broad range of British manufacturing sectors are expected to benefit from the extension, including food and drink and automotive, which is the second largest British export to South Korea.

See: British businesses celebrate as rules of origin to South Korea extended – GOV.UK (www.gov.uk)