The Basics of Small Business Accounts

Starting a new business is daunting, you have started your journey, following your dream to be your own boss. You know your product/service but what about your responsibilities as a business owner, filing accounts, tax returns, payroll? YOU need to be good at selling your business while MLS Accountancy are here to help with the legal requirements of running YOUR business.

Keeping a record of your financial transactions is crucial, monitoring money coming in (Sales and Revenue) and outgoings (Purchases, Expenses and Overheads). As the main objective is for your business is to make profit, accurate bookkeeping guarantees that you are using your funds correctly allowing you to make the right decisions to facilitate the growth of your business.

Sales/Money In

There are two types of Sale (Income)

Expenses/Money Out

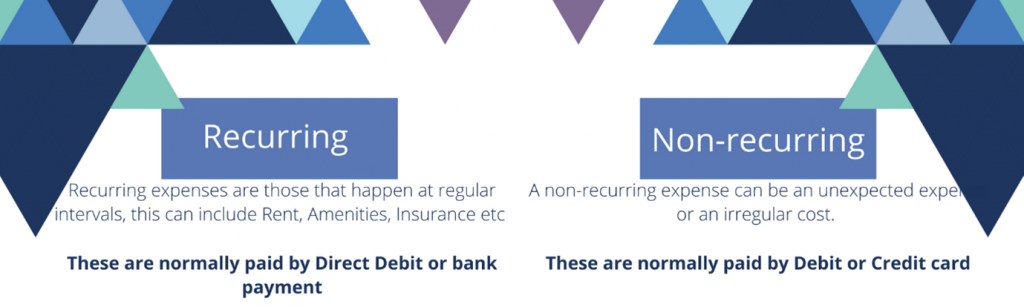

Expenses are either classified as recurring or non-recurring.

Steps to set up your small business bookkeeping

The following four steps are necessary in order to set up an efficient small business bookkeeping system:

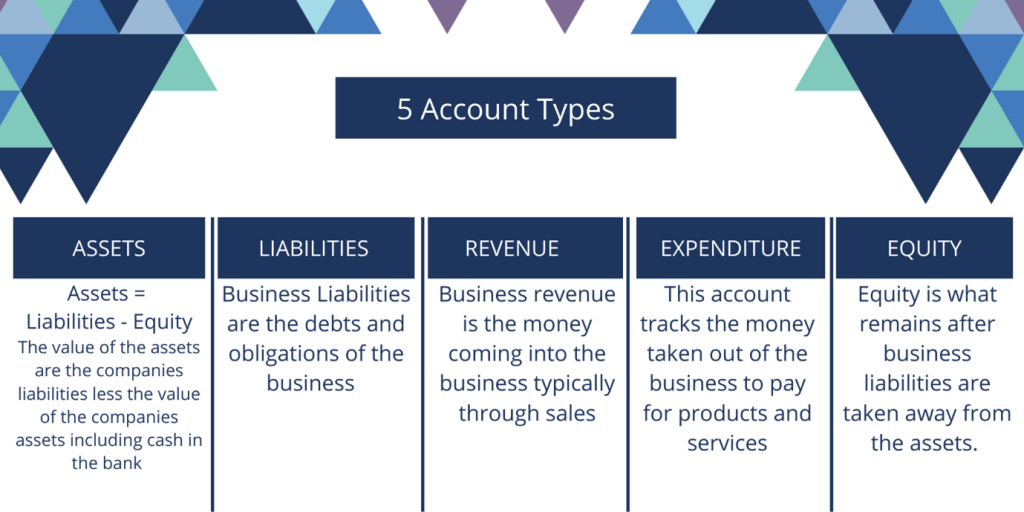

1 – Set up accounts, every account is classified under five types –

2. Record all financial transactions

After setting up your financial accounts, you now need to record the money flowing in and out of your business. Good Bookkeeping is imperative to give you a full picture of your business so that you can make informed decisions.

Most bookkeeping is based on double-entry. For every transaction you enter, there will be a equal entry in a different account. Always recording a debit and credit entry.

It is not compulsory to use a double-entry system, you can use a single-entry method. Single-entry bookkeeping is quicker than double-entry and can be useful if you only record a small number of financial transactions but it is limited in use and can make it difficult to produce important financial documentation, such as balance sheets.

3. Reconcile and close your books

Once your transactions are recorded, it is time to balance and close your books. Balancing your books means that you check your totals match when you add up the debits and credits. It is recommended that you balance your books at the end of each month to help you stay on top of your accounts. Reconciling on a monthly basis also makes it easier to complete your tax return accurately and on time.

4. Organise your financial statements

The reason bookkeeping it is so important is to allow you to create financial reports, these reports provide an important overview of the financial health of your business. There are many different financial reports, here are the most common ones used to provide a financial snapshot:

Balance Sheet – gives a summary of assets, liabilities and equity over a period of time.

Profit and Loss Statement (P&L) – gives a summary of your income minus your expenses over a period of time. The P&L helps identify revenue generated by specific products and services while identifying where money is being spent across the business. Regular reviews of the P&L will enable you to see opportunities to increase profits as well as reducing costs.

Cash Flow Statement – similar to the P&L however does not take into account non-cash transactions like depreciation.

How can MLS Accountancy help?

We understand that the largest businesses were once start-ups and the secret to making a business successful is management, at MLS Accountancy we work with you to manage your accounts while you manage your business.

For a FREE, no obligation consultancy email or call 07740 827 308.